Are you tired of dealing with the hassle of paper checks and lengthy payment processing times when it comes to paying your taxes? Look no further than IRS Direct Pay, a convenient and secure online payment system offered by the Internal Revenue Service (IRS). In this article, we'll delve into the world of Payment Lookup and explore the benefits of using IRS Direct Pay for your tax payments.

What is IRS Direct Pay?

IRS Direct Pay is a free online payment system that allows individuals and businesses to pay their federal taxes directly from their checking or savings account. This service is available 24/7 and can be accessed from the comfort of your own home or office. With IRS Direct Pay, you can make payments for a variety of tax types, including:

Form 1040 series (individual income tax returns)

Form 1041 (estate and trust income tax returns)

Form 1120 series (corporate income tax returns)

Form 941 (employer's quarterly federal tax return)

Benefits of Using IRS Direct Pay

There are numerous benefits to using IRS Direct Pay for your tax payments. Some of the most significant advantages include:

Convenience: IRS Direct Pay is available online, allowing you to make payments at any time and from any location.

Security: The system uses industry-standard encryption to ensure the security and confidentiality of your financial information.

Speed: Payments are typically processed within 24 hours, reducing the risk of late payment penalties and interest.

Accuracy: The system reduces the risk of errors and lost payments, ensuring that your payment is applied correctly to your tax account.

No Fees: IRS Direct Pay is a free service, with no additional fees or charges for using the system.

How to Use IRS Direct Pay

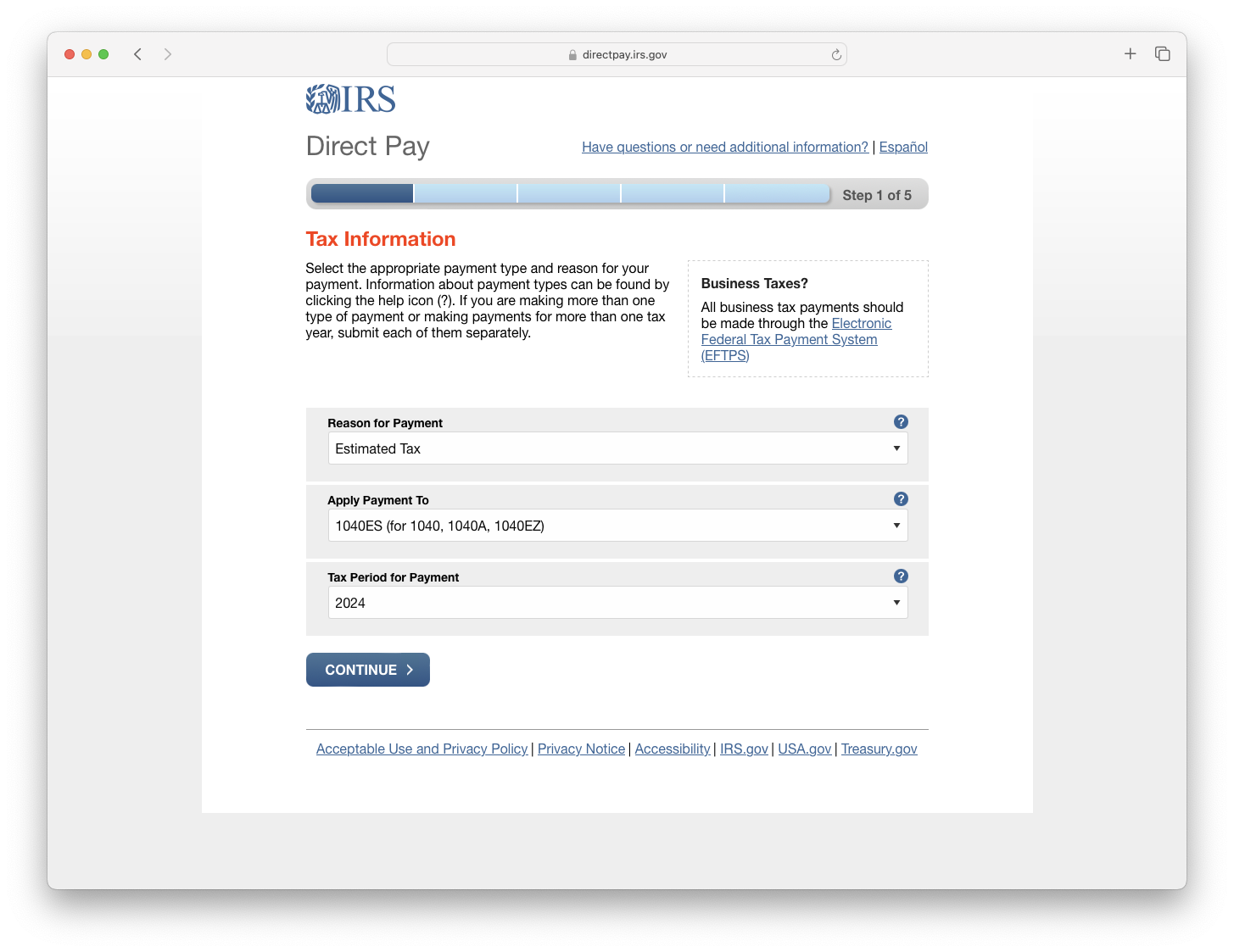

Using IRS Direct Pay is a straightforward process. Here's a step-by-step guide to get you started:

1. Visit the IRS website at

irs.gov and navigate to the Payment Options page.

2. Select the type of tax payment you want to make (e.g., individual, business, etc.).

3. Enter your payment information, including the payment amount and payment date.

4. Verify your identity and confirm your payment details.

5. Submit your payment and receive a confirmation number.

Payment Lookup: Tracking Your Payment

Once you've made a payment using IRS Direct Pay, you can use the Payment Lookup tool to track the status of your payment. This tool allows you to:

Verify that your payment has been processed

Check the payment amount and date

Confirm that your payment has been applied to your tax account

To access the Payment Lookup tool, simply visit the IRS website and navigate to the Payment Options page. From there, select the Payment Lookup option and enter your payment confirmation number and other required information.

In conclusion, IRS Direct Pay is a convenient, secure, and efficient way to pay your federal taxes. By using this online payment system, you can avoid the hassle of paper checks and lengthy payment processing times, and ensure that your payment is applied correctly to your tax account. Whether you're an individual or a business, IRS Direct Pay is a great option for making tax payments. So why wait? Sign up for IRS Direct Pay today and experience the benefits of streamlined tax payments for yourself.